Bet365 US expansion strategy is one of the most calculated moves in the online gambling world right now. Picture this: a British betting giant, born in a humble portable cabin, methodically conquering the massive American market state by state. While rivals splash cash on flashy ads and bonuses, Bet365 plays the long game—focusing on regulation, product quality, and sustainable growth. And it’s paying off, even if it means short-term hits to the bottom line.

You’re probably curious how this ties into the bigger picture at Bet365. Heavy investments in the US have been a key driver behind recent financial shifts, including the much-discussed denise coates bet365 pay package 2025 despite profit slump. But let’s zoom in on the strategy itself—it’s fascinating stuff.

Understanding Bet365 US Expansion Strategy: A Measured Approach

Why is Bet365’s entry into America so intriguing? Unlike some operators who rushed in post-2018 PASPA repeal and then retreated, Bet365 has been deliberate. They prioritize licensed, regulated markets over quick wins in grey areas. Analogy time: it’s like building a sturdy house brick by brick instead of throwing up a tent that might blow away in the wind.

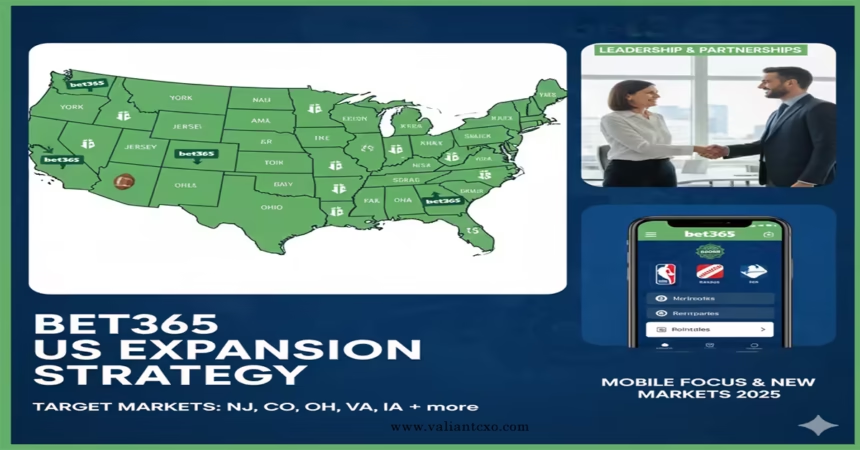

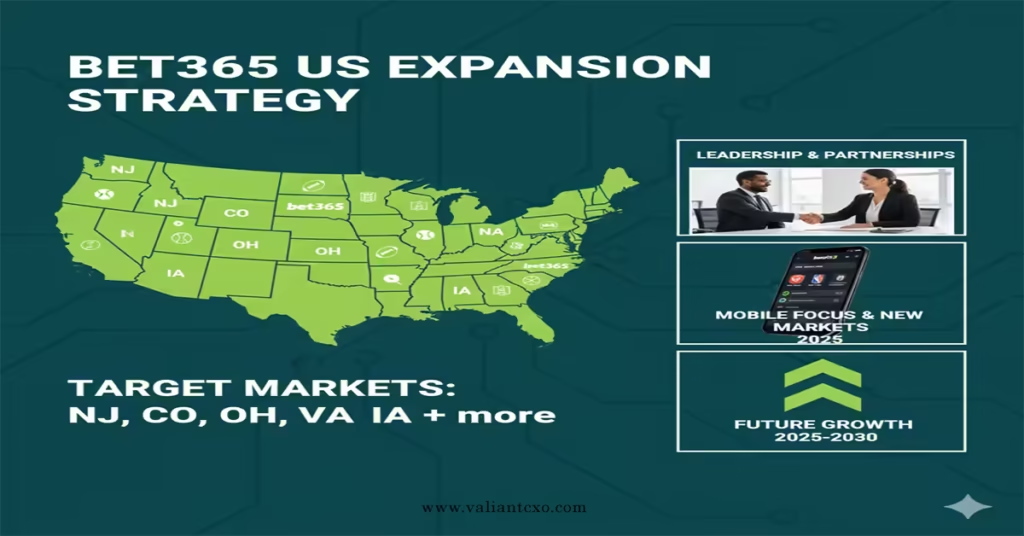

Since launching in New Jersey back in 2019, Bet365 has steadily added states, reaching 16 by late 2025. This isn’t about dominating overnight; it’s about creating a foundation for long-term dominance in a market projected to explode.

Key Pillars of Bet365 US Expansion Strategy

What makes this strategy tick? A few core elements stand out:

- Partnerships with Local Entities: Bet365 often teams up with casinos or tribes for market access. Think Century Casinos in Colorado or the Charlotte Hornets in North Carolina—these deals ensure compliance and local buy-in.

- Focus on Product Excellence: Instead of bonus wars, they bet on superior odds, in-play betting (their specialty), and seamless apps. Users rave about features like early payouts and bet builders.

- Infrastructure Investments: They didn’t just flip a switch—they bought a $135 million HQ in Denver, planning to hire over 1,000 staff. That’s commitment!

Rhetorical question: in a crowded field with DraftKings and FanDuel throwing money around, how does a foreign brand gain traction? By being patient and superior, that’s how.

Timeline of Bet365 US Expansion Strategy in Action

Let’s break down the rollout—it’s been a busy few years.

Bet365 started small but accelerated:

- Early entries: New Jersey (2019), Colorado (2022), Ohio and Virginia (2023).

- 2024 boom: Arizona, Indiana, Kentucky, Louisiana, North Carolina, Pennsylvania.

- 2025 additions: Tennessee and Illinois (March), Kansas (August), Maryland (September), Missouri (December).

By December 2025, they’re live in: Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Missouri, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, and Virginia.

That’s 16 states! Each launch involves navigating regulators, securing licenses, and tailoring offerings. No wonder costs spiked.

Recent Launches Highlighting Bet365 US Expansion Strategy

Take 2025’s moves:

- Tennessee and Illinois (March 2025): Independent in Tennessee, partnered with Walker’s Bluff in Illinois. Timed perfectly for March Madness boosts.

- Kansas (August 2025): Brought their full sportsbook suite.

- Maryland (September 2025): Capitalized on NFL season kickoff.

- Missouri (December 2025): Deal with St. Louis Cardinals for marketing muscle.

These aren’t random—they target passionate sports states with growing betting appetites.

Challenges and Costs Behind Bet365 US Expansion Strategy

No expansion is painless. Bet365’s push contributed to a profit dip in the year to March 2025—pre-tax profits fell ~45% despite 9% revenue growth to £4 billion.

Why? Massive expenses: licensing, marketing (subtle but effective), tech upgrades, and staffing. Plus, exiting grey markets like China to clean up for US scrutiny.

It’s like upgrading your car engine—you spend big upfront for better performance later. Investments in unified casino platforms and new suppliers bolstered iGaming, up 25%.

This context explains narratives around executive compensation, such as the denise coates bet365 pay package 2025 despite profit slump—rewards for steering through costly growth phases.

Competition in the US Market

Bet365 holds ~3-6% share in most states—solid but not leading. Rivals like FanDuel (often 40%+) dominate with aggressive promos.

Bet365’s edge? Global expertise in soccer and in-play, plus lower overheads. They’re gaining ground in niches like women’s sports betting, up hugely.

Future Outlook for Bet365 US Expansion Strategy

Where next? More states could legalize, but Bet365 eyes deepening existing markets. Rumors of a US IPO or sale swirl—valuing the company at £9-12 billion—to fuel further growth.

With a Denver HQ humming and product innovations rolling, they’re positioned for when iGaming expands (currently limited to NJ/PA).

Broader trends: rising women’s sports wagering, prop bets, and regulated focus align perfectly with Bet365’s strengths.

Potential Risks and Opportunities

Risks: Tougher regulations, competition, addiction scrutiny.

Opportunities: Untapped states, casino growth, partnerships (e.g., horse racing fixes).

Bet365 US expansion strategy screams confidence in America’s potential—analysts forecast $23+ billion market by 2029.

How Bet365 US Expansion Strategy Impacts the Broader Company

This isn’t isolated—it’s core to Bet365’s pivot to sustainable, regulated revenue. Exiting risky spots for US growth shows foresight.

It boosted gaming revenue massively, offsetting sports dips. Long-term? Huge payoff as US matures.

Ties back to leadership decisions, including those reflected in stories like denise coates bet365 pay package 2025 despite profit slump—betting big requires bold moves.

Conclusion

Bet365 US expansion strategy is a masterclass in patience and precision. From humble UK roots to 16 US states, they’ve invested heavily in regulation, infrastructure, and product—accepting short-term pain for massive gain. Revenue climbs, market share grows, and the future looks bright in the world’s biggest betting frontier.

Whether you’re a punter eyeing better odds or just fascinated by business savvy, Bet365’s American adventure is one to watch. It’s proof that slow and steady can win the race—even in gambling.

What state do you think they’ll tackle next? The strategy keeps evolving.

FAQs

What is the core of Bet365 US expansion strategy?

Bet365 US expansion strategy emphasizes regulated markets, local partnerships, and superior product features over aggressive marketing, leading to steady growth across 16 states by 2025.

How many states is Bet365 live in as of 2025?

As of December 2025, Bet365 operates in 16 US states, with recent additions like Missouri highlighting the ongoing Bet365 US expansion strategy.

Why did profits dip amid Bet365 US expansion strategy?

Heavy investments in launches, HQ, and tech drove costs up, contributing to the profit slump discussed alongside topics like denise coates bet365 pay package 2025 despite profit slump.

What makes Bet365 US expansion strategy different from competitors?

Unlike bonus-heavy rivals, Bet365 US expansion strategy focuses on quality odds, in-play betting, and long-term sustainability, building loyal users organically.

Will Bet365 US expansion strategy include more states soon?

While no announcements yet, Bet365 US expansion strategy targets regulated growth, potentially eyeing new legalizations or deeper penetration in current markets.